Home > Industries > Real Estate

Real Estate Risk Management Software

Strengthen your real estate portfolio’s resilience and maximize CapEx efficiency with Aclaimant—the all-in-one, insight-powered platform for proactive risk management

Trusted by Leading Companies

Elevate Efficiency with Aclaimant’s Real Estate Risk Management Software

Aclaimant's real estate risk management software streamlines operations, automates claims processes, and mitigates risks across multiple properties. Simplify incident reporting, reduce administrative burden, and connect field teams using real-time mobile tools.

With centralized data, teams can instantly access safety insights, reducing claim frequency, managing commercial real estate risks, and increasing asset utilization.

Reduce the Cost of Risk for Real Estate Operations

Minimize property and operational risks by implementing proactive and preventative measures across your real estate portfolio. Leverage data-driven insights to identify potential hazards early, safeguard assets, and enhance your position in insurance negotiations.

Automated safety reporting ensures regulatory compliance, saving time and boosting operational safety. Aclaimant's property risk management software promotes a culture of safety and accountability across all teams.

Unlock New Revenue with Real Estate Risk Management Solutions

Minimize financial exposure, reduce claims, and create new business opportunities with Aclaimant's risk management software. By showcasing effective risk management processes, you can gain a competitive edge, secure more contracts, and build lasting customer trust.

Efficient risk management in real estate also contributes to a strong reputation, resulting in increased customer loyalty and new client acquisitions.

How It Works

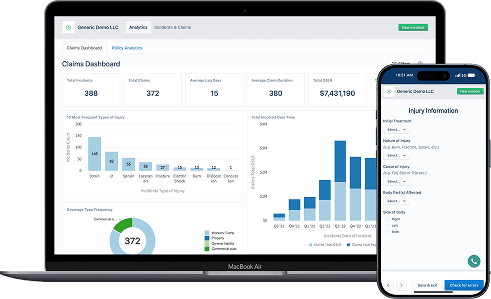

Claims Analytics and Loss Run Dashboards

Access tailored dashboards to pinpoint key areas for improvement in your real estate claims management.

Mobile FNOL and Digital Claims Submission

Empower your teams to submit incident reports instantly with mobile-first tools.

Return-to-Work Management and Compliance

Ensure compliance and effectively manage return-to-work timelines.

Safety and Property Control

Leverage Aclaimant's tools to track safety measures across all properties in real-time.

Predictive Models

Use AI-powered predictive analytics to proactively manage the performance of your real estate portfolio and avoid risks.

What Our Customers Are Saying

Brandie Meisner

Jerry Jones

Learn More About Real Estate Risk Management Solutions

ACLAIMANT FOR REAL ESTATE

At Aclaimant, we work with real estate companies like yours to digitize risk and safety strategies. Our Active Risk Management approach empowers your teams to more proactively manage risk by leveraging technology that is centralized, connected, scalable, and data-driven to deliver results such as 21.7% savings on insurance claim costs. Learn more in our quick overview linked below.

ACTIVE RISK MANAGEMENT E-BOOK

Transform Risk Waste into opportunity. Most companies don't understand what Risk Waste is or how to measure it. Risk Waste is all the direct and indirect costs associated with managing risk within your organization. In this e-book, we expand on three areas: financial, productivity, and morale waste, in which your real estate company may be experiencing Risk Waste and how it's costing you.

Optimize Your Real Estate Risk Management Now

Expand Your Knowledge on Construction Risk Management

Your Real Estate Risk Management Questions Answered

1. What is risk management in real estate?

Risk management in real estate involves identifying, evaluating, and mitigating risks to ensure operational safety, compliance, and financial stability across property portfolios. It’s essential for maintaining the integrity and profitability of real estate investments.

2. What are the 5 types of risk management?

The primary types of risk management in real estate include:

- Hazard Risk: Risks associated with physical damage or injury.

- Financial Risk: Risks related to market fluctuations and funding.

- Operational Risk: Risks arising from internal processes and systems.

- Strategic Risk: Risks linked to business strategy and market positioning.

- Compliance Risk: Risks associated with adhering to laws and regulations.

3. What are the major risks in the real estate industry?

Key risks in the real estate industry include market fluctuations, property maintenance issues, tenant challenges, regulatory compliance, and environmental hazards are all significant risks.

4. What are the risk measures in real estate?

Routine risk assessments, safety compliance, automated reporting, and the use of real estate risk management software for continuous tracking are all effective measures.

Book a Demo Today

Take charge of your real estate risk management processes with Aclaimant’s intuitive software. Book a demo today to discover how our platform can enhance risk visibility, streamline your processes, and boost operational efficiency. Don’t miss the opportunity to transform your risk management strategy!

Company

Product

Resources

Privacy Policy Security Terms Responsible Disclosure Help Center

© 2024 Aclaimant 330 N. Wabash, 23rd Floor, Chicago, IL (312) 361-3477