Home > Who We Serve > Insurance Carriers & TPAs

Comprehensive Insurance Risk

Management Software

Strengthen insurance risk management with Aclaimant’s platform. Automate compliance, simplify

claims, and streamline workflows for insurers, TPAs, and risk teams.

Trusted by Leading Insurance Carriers & TPAs

What is Insurance Risk Management Software?

Aclaimant’s insurance risk management software provides insurance carriers and third-party administrators (TPAs) with a centralized platform to manage risks more efficiently.

Our software facilitates strategic planning, compliance, and accurate risk assessments throughout all insurance and TPA workflows. This integrated system streamlines your processes, increases visibility, and empowers your team to save money and improve results.

Shift to a Proactive Insurance Risk Management Strategy

-

Cultural Transformation

Aclaimant’s insurance risk management platform encourages a proactive approach by providing tools that help teams identify and mitigate risks early. Instead of reacting to incidents, organizations can address vulnerabilities before they escalate.

-

Enterprise-Wide Coordination for TPA and Insurance Carrier Risk Management

Aclaimant’s TPA and insurance risk management software enables cross-department collaboration, improving compliance oversight, internal audits, and risk mitigation strategies across insurance carriers and TPAs.

A Holistic Approach to TPA and Insurance Risk Management

-

Seamless Integration with Existing Risk Management Systems

Aclaimant’s risk management insurance software integrates with existing risk and claims systems, providing a unified view of compliance, claims, and operational risks while reducing inefficiencies.

-

Enhanced Visibility into Insurance Risk Exposure

With Aclaimant’s insurance policy management software, insurers and TPAs can track risk exposure, optimize claims processing, and ensure compliance with industry regulations—minimizing financial risks and operational disruptions.

Real-Time Solutions for TPA Claims Management

-

Tailored TPA Claims Management Software for Tailored Needs

Our TPA claims management software streamlines claims handling, compliance, and cost control, helping TPAs manage risk more effectively and reduce delays.

-

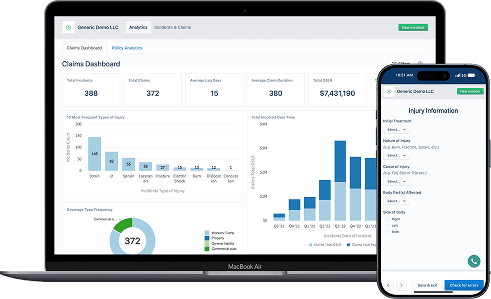

Advanced Analytics and Real-Time Reporting for Insurance Risk

With real-time reporting on claims, compliance, and risk trends, insurers and TPAs can make data-driven decisions that improve incident prevention and loss mitigation.

Secure & Streamlined TPA Software Solutions

-

Simplify Digital Incident Reporting for TPAs & Insurers

Our TPA software solutions enable accurate and secure digital incident reporting, improving operational efficiency and ensuring compliance for insurance companies and TPAs.

-

On-the-Go Risk Management with Mobile Access

Aclaimant’s mobile-friendly insurance risk management platform enables real-time data capture, claim updates, and compliance monitoring from anywhere, ensuring seamless risk management on the move.

A Risk-Aware Strategy for Today’s

Insurance Carriers & TPAs

Aclaimant's platform provides a risk-aware strategy that helps carriers and TPAs remain compliant, streamline claims, and improve operational efficiency.

What is Insurance Risk Management Software?

Insurance risk management software is vital for modern insurance carriers and TPAs because it combines strategic planning, compliance management, and real-time risk assessments. Aclaimant's platform offers a unified interface for assessing and managing risk, allowing businesses to make better decisions and reduce operational inefficiencies.

Tailored Risk Management Solutions for Insurance Carriers & TPAs

Aclaimant’s insurance Carrier & TPA Risk Management Software adapts to your organization’s needs—whether for claims management, compliance tracking, or policy risk analysis. Our customizable framework provides a flexible approach to risk planning and execution, ensuring that all departments stay aligned and equipped to handle evolving risks.

Why Choose Aclaimant’s Insurance Risk Management Tools?

Aclaimant's risk management software integrates seamlessly with existing systems, providing your team with comprehensive insurance policy management software. With real-time analytics and intuitive workflows, our platform improves data accuracy, simplifies claims management, and strengthens your overall risk strategy.

Enhance Efficiency with Aclaimant’s TPA Software Solutions

Aclaimant's insurance risk management platform improves TPA claims management by leveraging advanced data analysis and secure processing. Our TPA claims management software provides a unified approach to managing risk and claims with precision, delivering clear insights and operational efficiency throughout your organization.

Risk Managed, Claims Controlled, Compliance Secured

Don’t just take our word for it. See whatour customers have to say about us.

Aclaimant has streamlined our claims process significantly, saving us countless hours and improving data accuracy across our entire team

Risk Manager at Leading TPA

The platform’s automated workflows have not only enhanced our efficiency but have also reduced our administrative workload substantially

Operations Director, Major Insurance Carrier

Optimize Risk, Compliance & Claims with Aclaimant

Policy Management and Claims

Use our platform for seamless insurance policy management software, TPA claims management, and incident tracking.

Enhanced

Compliance

Stay up to date with regulatory requirements through built-in compliance tools for insurance carriers and TPAs.

Data-Driven

Insights

Leverage advanced analytics to optimize claims management and policy administration, maximizing accuracy and efficiency.

Your Insurance Risk Management Questions Answered

1. What is insurance risk management software?

Insurance risk management software companies help carriers and TPAs streamline claims, improve compliance, and centralize data, enabling efficient and accurate risk management.

2. How does insurance policy management software work?

Insurance policy management software consolidates policy data, claims history, and compliance tracking into a single platform. This enables insurance carriers and TPAs to manage policies efficiently, reduce errors, and improve oversight.

3. What are the benefits of TPA claims management software?

TPA claims management software automates claims processing, ensures regulatory compliance, and improves data accuracy, helping TPAs manage claims efficiently.

4. How can Aclaimant’s software support insurance carriers and TPAs?

Aclaimant’s platform integrates claims, compliance, and policy management into one streamlined system. Insurance carriers and TPAs benefit from greater efficiency, reduced administrative burdens, and improved risk visibility.

Book a Demo Today

Experience the difference Aclaimant’s insurance risk management software can make for your organization. Schedule a demo to see how we can streamline your claims and compliance processes for greater efficiency and accuracy.

Company

Product

Resources

Privacy Policy Security Terms Responsible Disclosure Help Center

© 2024 Aclaimant 330 N. Wabash, 23rd Floor, Chicago, IL (312) 361-3477