DIPDashTM

Aclaimant's Proprietary Data Ingestion Pipeline Dashboard

Revolutionize your insurance and claims data management

Tired of drowning in poor-quality, inconsistent insurance data? Aclaimant's DIPDash is a cutting-edge, multi-stage ETL platform designed to automate and streamline the entire data lifecycle. From automated ingestion to robust validation and transformation, DIPDash empowers insurers, TPAs, brokers, and policyholders to unlock the power of clean, reliable data, driving efficiency, transparency, and better decision-making

The Insurance Data Quality Crisis

The insurance industry struggles with significant data management challenges.

Key pain points include:- Poor Data Quality: Claims data is often inconsistent, inaccurate, or incomplete, hindering effective risk management and analysis.

- Data Silos and Variety: Data resides in disparate systems and formats (CSV, PDF, etc.) with varying structures, making consolidation difficult.

- Manual Processes: Data acquisition, preparation, and validation are often manual, time-consuming, and error-prone.

- Lack of Transparency: Data pipelines are often opaque, making it hard to identify and resolve data issues.

- Data Loss and Changes: Data sources may drop fields or change data formats without notice, compromising data integrity and challenging traditional data pipes.

These challenges lead to inefficiencies, increased costs, poor decision-making, and hindered innovation.

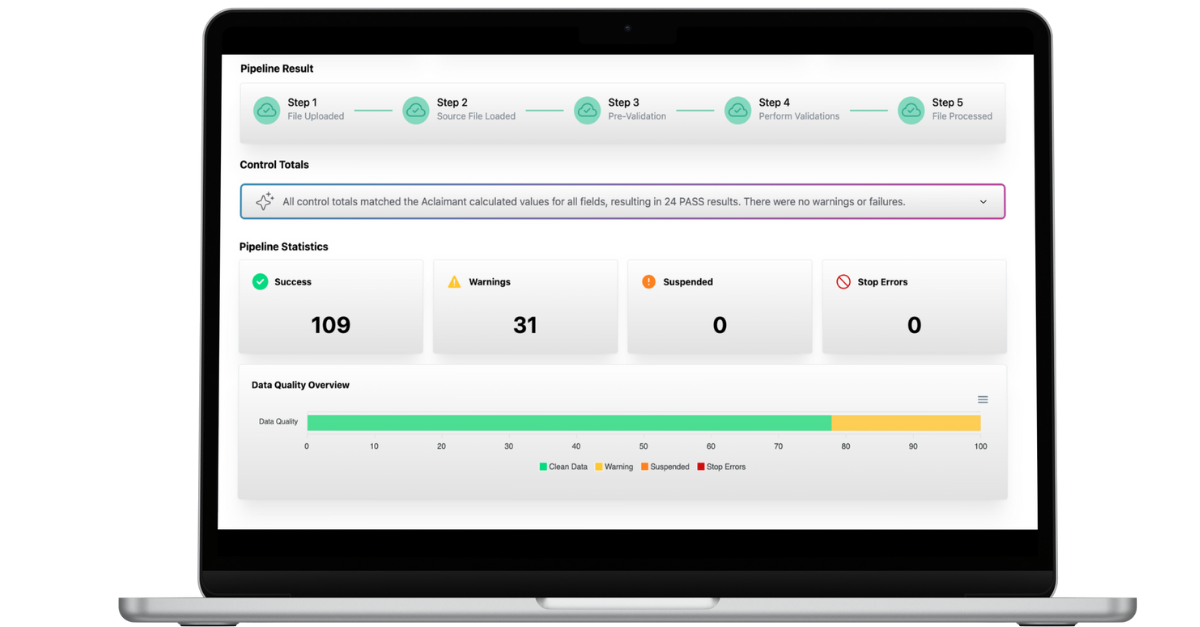

HOW DIPDASH WORKS

DIPDash: A Holistic Data Management Solution

DIPDash is a specialized multi-stage ETL and pipeline visualization tool tool that automates and optimizes the entire insurance and claim data lifecycle. It provides a comprehensive solution for data ingestion, transformation, validation, and loading. Here's how it works:

- Automated Data Ingestion: DIPDash automates the monitoring and ingestion of data from various sources (including Carriers, TPAs) via SFTP or API. It alerts teams to missing files and automatically processes data upon receipt.

- Data Transformation and Standardization: DIPDash transforms any file type into a digestible format, validates the presence and formatting of data, and normalizes it into a unified Aclaimant format.

- Robust Data Validation: DIPDash employs multi-stage validation, including initial validation, validation after normalization, and post-load validation. This encompasses data format validations, logical validations, business rule validations, and customer-specific validations with customizable rules and escalations.

- Data Loading/Output: DIPDash loads the transformed and validated data into the Aclaimant platform or other target systems.

.gif)

KEY FEATURES AND BENEFITS

DIPDash: Key Features

DIPDash delivers a powerful combination of features and benefits, including:

- Automated Data Ingestion: Automates data acquisition from Carriers and TPAs.

- Data Transformation and Standardization: Transforms and normalizes data from various formats and sources.

- Robust Data Validation: Multi-stage validation with customizable rules and escalations.

- Visual Interface: Provides a user-friendly interface for non-developers to manage data pipelines.

- Carrier/TPA Data Quality Scorecard: Enables monitoring and improvement of data quality at the source.

- Data Append and Extend: Enriches data with external sources and derives new data fields.

- Auditable Trail: Maintains a complete history of data quality activities.

- Scalable Solution: Handles data from hundreds of standard fields across major P&C lines of insurance.

Get all of the right information, every time.

DIPDash: Experience the Aclaimant Difference with your data.

BEYOND YOUR STANDARD ETL SOLUTION TAILORED FOR THE INSURANCE INDUSTRY

- No-Code Visual Interface: Empowers business users to manage data pipelines without coding expertise.

- Proactive Data Quality Management: Carrier/TPA scorecards drive data quality improvements at the source, fostering collaboration.

- Intelligent Data Enrichment: Appends external data and derives new insights to maximize data value.

DIPDash for every insurance stakeholder

DIPDash delivers value across the insurance ecosystem

FOR EVERYONE

- Carriers: Improve data quality from TPAs and partners, automate claims data ingestion, and gain a holistic view of risk.

- TPAs: Streamline data delivery to carriers or ingested from other sources, reduce errors, and enhance reporting capabilities.

- Brokers: Consolidate client data from multiple sources for better analysis and service.

- Policyholders: Benefit from better data visibility and higher confidence in your risk management and management platforms

DIPDash supports all commercial P&C lines, including WC, Auto, GL, and Property, with flexible data frequency (daily, weekly, monthly, quarterly) and one-way data flow into Aclaimant."

Take Control of Your Data Today

Ready to transform your insurance data management? Contact us to Request a Demo, Speak with a Solutions Expert or Learn More about DIPDash Pricing"

Company

Product

Resources

Privacy Policy Security Terms Responsible Disclosure Help Center

© 2025 Aclaimant 330 N. Wabash, 23rd Floor, Chicago, IL (312) 361-3477