CFO Dashboard

A simple way to track progress across the key metrics that drive ROI for your business and will make any CFO happy

Active risk management converts cost to profit.

Turn passive risk management into profitable risk management.

Risk teams often have difficulty showing the results of their efforts. They often rely on adhoc or manual reports to provide to their upper management. Often, these only tell half the story.

The Aclaimant CFO Dashboard automatically tracks real-time progress across key value-driving metrics. Show your management, leadership, or board of directors how your efforts minimize claims costs and drive profits. It's a click away.

.png)

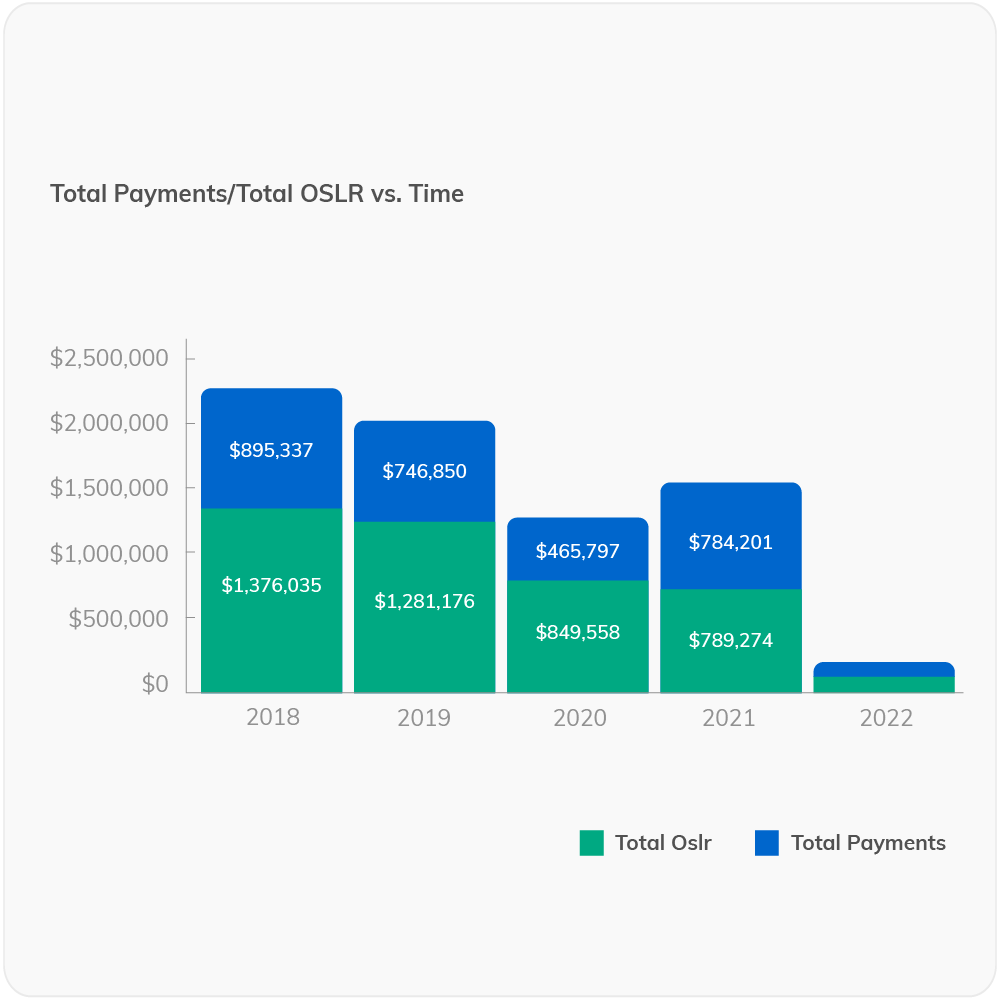

Track your payments and reserves over time

Monitor your incurred claim cost over time and review paid versus OSLR to understand the historical trend of your performance and exposure.

Tracking how the cost of your claims has trended over time is the first metric you’ll be able to showcase as you move to a more active approach to risk management. As you measure your progress over time, you’ll be able to understand how much of your claims cost for a given year is already paid vs. reserved. Identify where your costs are more finalized and where you still have the opportunity to manage and monitor costs.

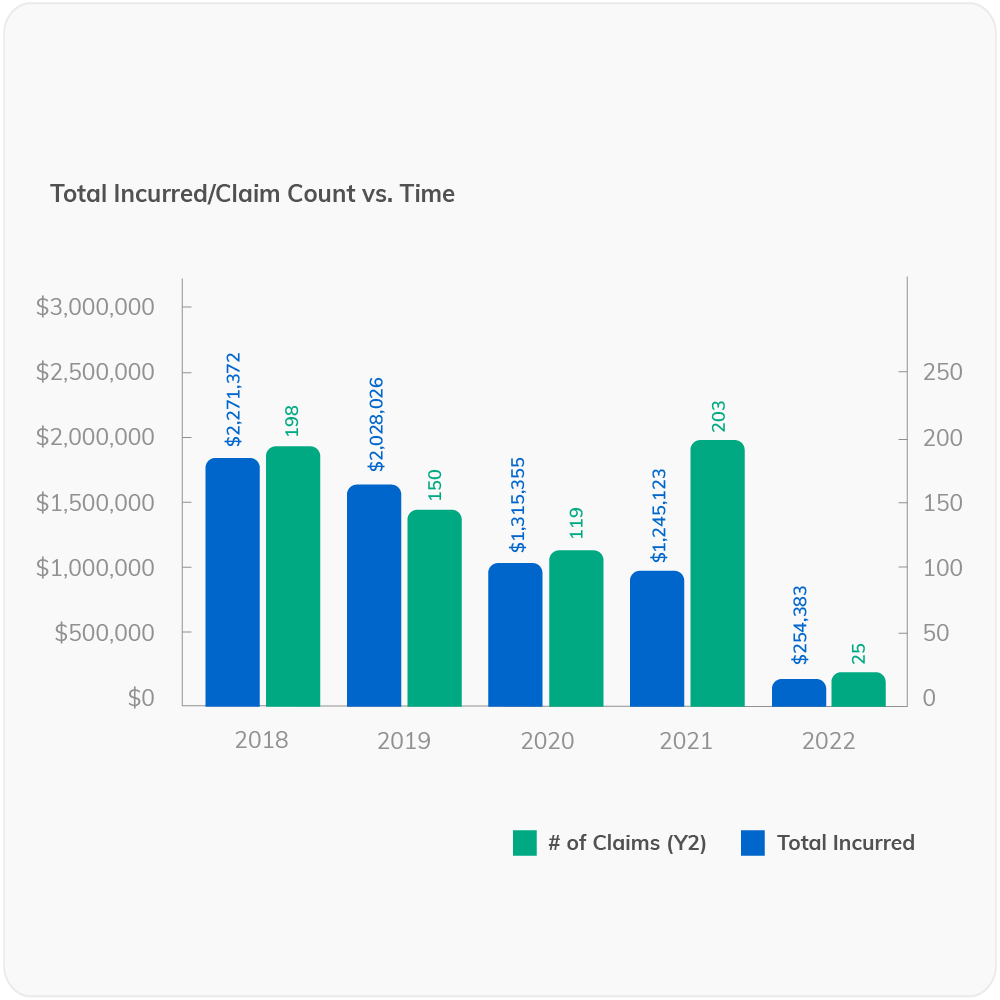

Watch your claim counts and incurred cost over time

Show management side by side progress on claim frequency and severity.

As a risk manager, your positive impact will result in both a reduction in frequency and severity of claims. Track both side by side over the year to help showcase how your organization is trending across both key metrics and safety initiatives.

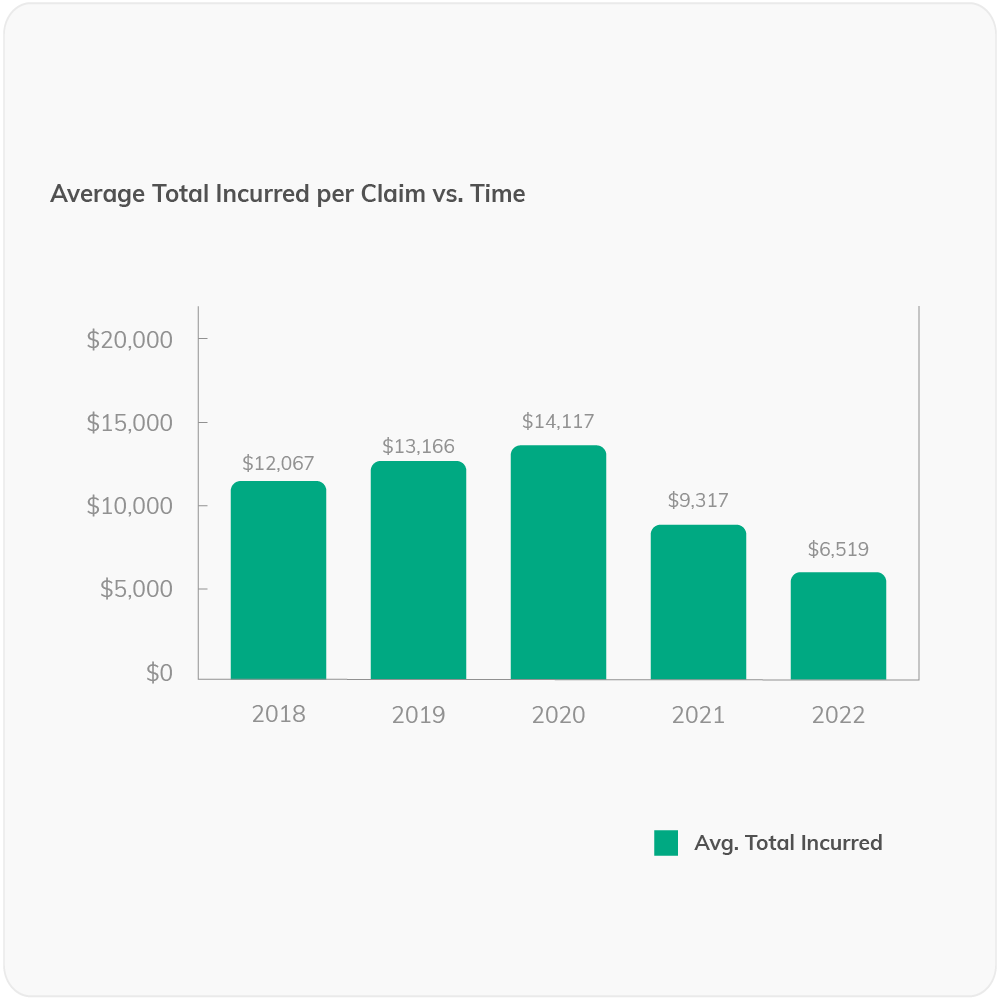

Review your average claim cost over time

Show how your risk management activities impact claim severity and cost over time.

How do you show that your claim case severity is improving? One best practice is to monitor your average cost per claim. Initiatives like technology rollouts or process improvements may be hard to measure individually, but looking at the overall cost per claim can showcase how your team has improved their ability to triage and drive down the average cost per claim over time.

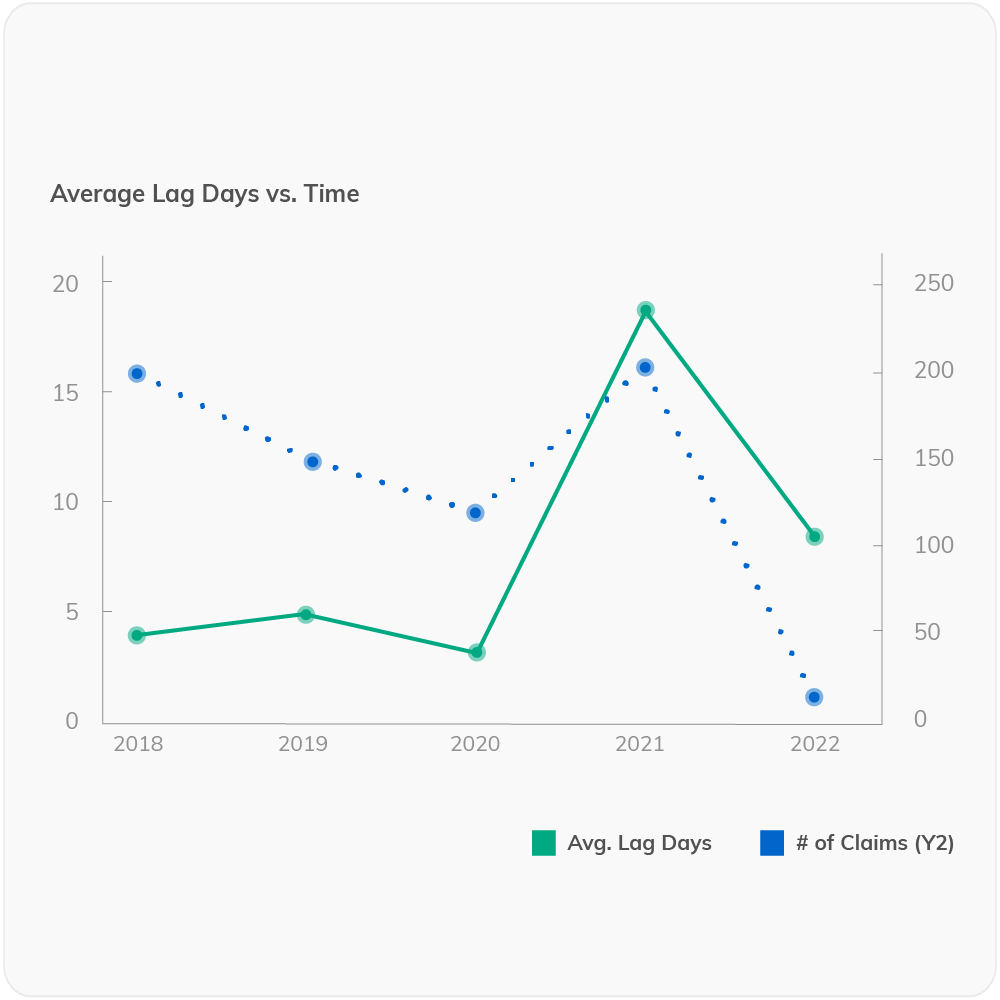

Monitor your lag time in real time

Put your response time to the test, and see if your risk management team is increasing their responsiveness and efficiency.

Many risk teams struggle to convey to their organizations the importance of immediate incident reporting. Oftentimes, the incidents that get missed and drive up lag time increase the risk of severity and the chance of litigation. Monitoring your team's ability to improve its responsiveness can help you showcase improvements in the first step of the claim reporting process and set your team up for successful claim mitigation and triage.

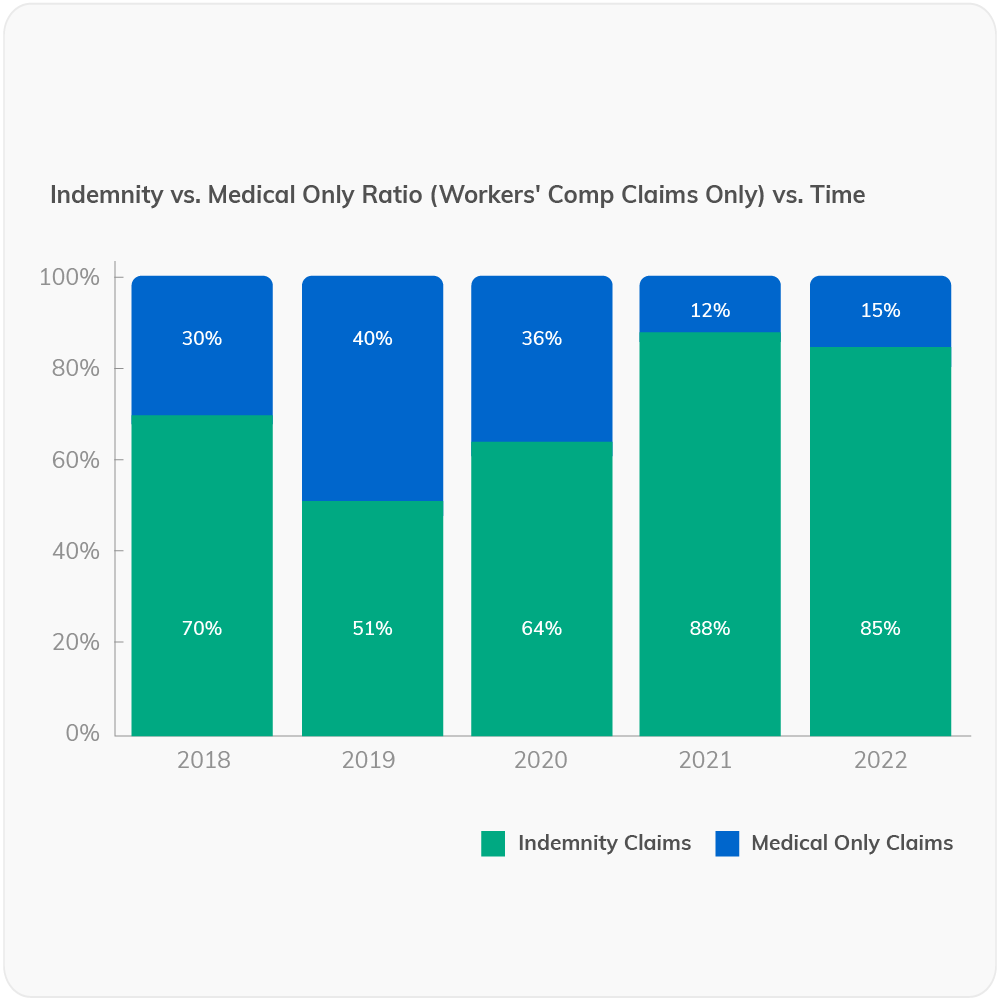

Track how many claims end up as medical-only versus indemnity

Promote your risk team’s precision by tracking their ability to drive down the percentage of claims that move from medical-only to indemnity.

Experienced risk professionals know that indemnity claims are more expensive than medical-only claims. An Active Risk Management approach can improve things like response rate, triage, better prevention and mitigation that reduce the percentage of claims that move from medical-only to indemnity. Fewer indemnity claims mean lower average claim costs and faster resolution times.

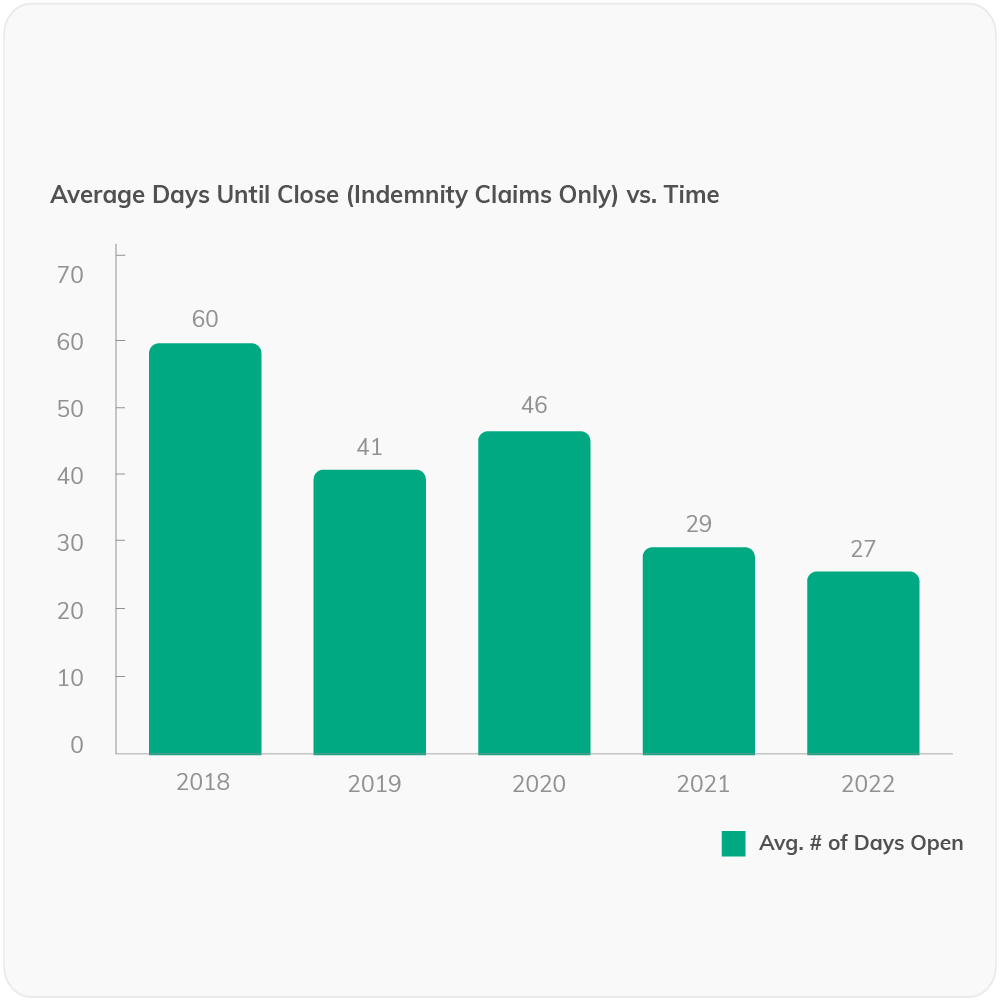

Monitor how fast you are closing indemnity claims

Track your efforts and productivity in driving down the complexity of your indemnity claims, which tend to be more expensive & longer than medical-only claims.

Indemnity claims typically involve employees who miss work. These claims tend to involve more complexity, last longer and may involve an employee who has missed some work. Actively managing these claims and utilizing a robust return to work program can result in faster closure of indemnity claims. Isolating results on these claims can help to showcase the results of your efforts to combat indemnity claim costs.

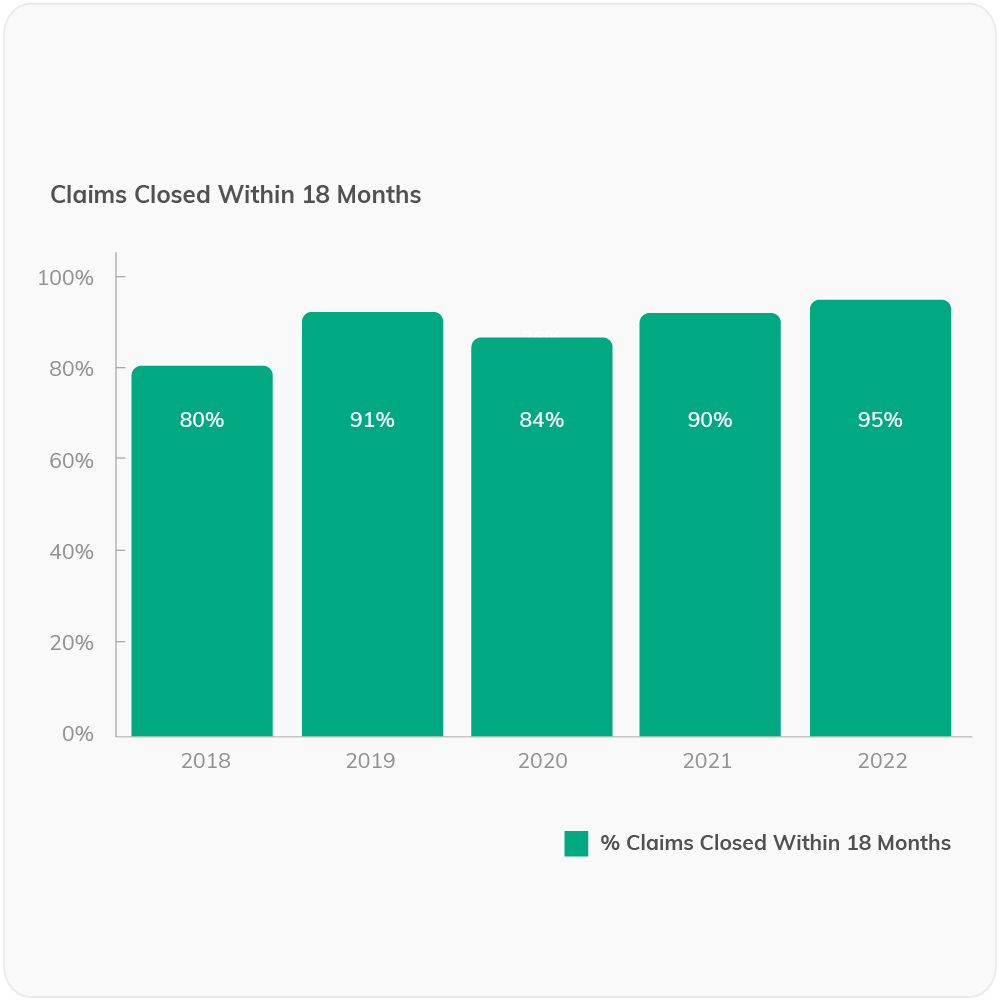

Claims closed within 18 months of occurrence

Track your risk team's ability to get claims closed faster, resolving open issues through more proactive management.

The reality of most claims is that duration impacts the overall cost. The number of ongoing efforts your team and your insurance partners spend managing them is an important KPI for most risk teams. Begin tracking the percentage of claims that close within 18 months so that you can understand how your team's efforts are improving the efficiency and throughput of claims.

Track your teams activity to highlight your efforts

Showcase your risk management team’s effort and efficiency.

Productivity has never been an exact science, and most risk management tools don’t even have a way to indicate the efficiency of your risk management team. Now you can show management the processing power or your risk managers. Help to highlight how many activities your team has completed, changes over time, and provide insight into how much work your team completes on a day-to-day basis.

Get all the right information, all the time.

Companies using Aclaimant reduce administrative burden by 12 hours for every claim.

RISK MANAGEMENT CONVERTED TO PROFIT

Everything starts with how your team captures the most critical information, and what you do with that information. Aclaimant's CFO dashboards empowers your team to show their effectiveness across the key metrics that drive value.

When you are able to clearly show how you're minimizing cost and exposure, every dollar you put in your risk program works harder. Turn passive risk management into profitable risk management.

To use the CFO Dashboard, customers must have incident and claims data, complete loss runs data (including close dates & dollars), and standard Aclaimant workflow set-up (this excludes legacy customer set-ups with workflows not compatible with the CFO dashboard). Please reach out to customer.success@aclaimant.com for information.

Company

Product

Resources

Privacy Policy Security Terms Responsible Disclosure Help Center

© 2021 Aclaimant 330 N. Wabash, 23rd Floor, Chicago, IL (312) 361-3477